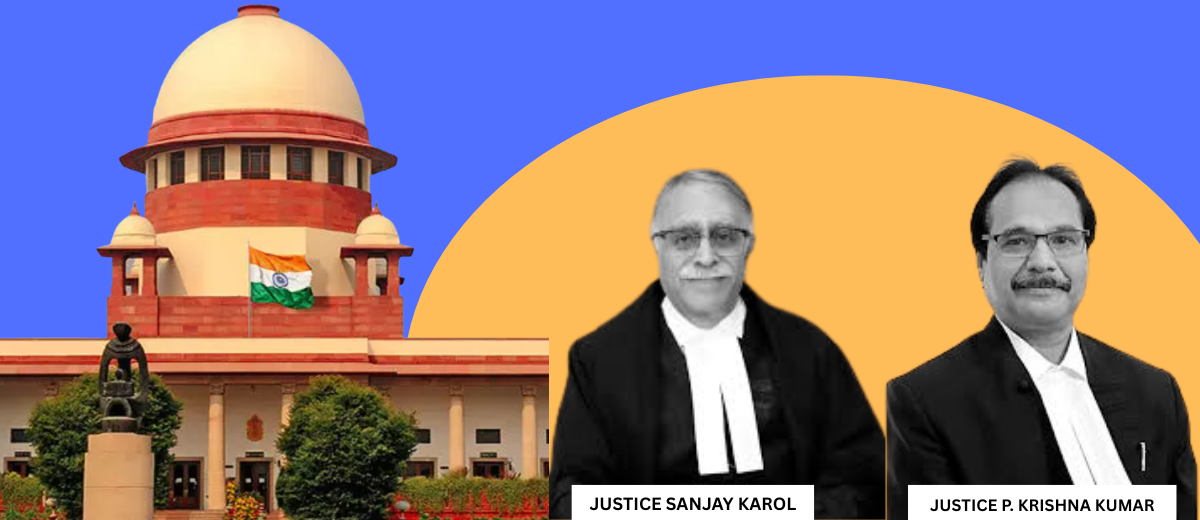

Case Name: STATE OF WEST BENGAL AND ANR. VS. CONFEDERATION OF STATE GOVERNMENT EMPLOYEES, WEST BENGAL AND ORS.

Petition Number: C.A. Nos. arising out of SLP (C) Nos. 22628-22630 of 2022 & connected matters

Citation: 2026 INSC 123

Date of Judgment: 05.02.2026

Hon’ble Judges / Coram: HON’BLE MR. JUSTICE SANJAY KAROL & HON’BLE MR. JUSTICE PRASHANT KUMAR MISHRA.

Background:

This case revolves around the long-standing dispute over the non-payment of Dearness Allowance (DA) arrears for the period of 2008-2019 to West Bengal government employees. The judgement clarified important questions about the binding nature of Pay Commission recommendations once accepted, and whether a State can deny statutory service benefits on the ground of financial constraints.

Facts of the Case:

The West Bengal Government constituted the Fifth Pay Commission in 2008. Based on its recommendations, the State formulated the West Bengal Services (Revision of Pay and Allowance) Rules, 2009 (RoPA Rules) under Article 309 of the Constitution, with retrospective effect from 1 January 2006. These rules included DA as a component of wages, linked to inflation measured by the All-India Consumer Price Index (AICPI). Although DA rates were periodically notified, the State failed to pay DA for certain periods, delayed payments, and paid DA at rates far lower than those granted to Central Government employees.

State government employees and their unions filed OA No. 1154 of 2016 before the West Bengal Administrative Tribunal seeking payment of DA and arrears. The Tribunal initially dismissed the application, stating that DA was not a legally enforceable right. On appeal, the Calcutta High Court overturned the Tribunal’s decision, holding that DA was an enforceable right, and sent the matter back for reconsideration. After remand, the Tribunal directed the State to establish rules for DA calculation based on AICPI and to pay the arrears. In the following round, the High Court upheld these directions and held that DA is linked to the right to live with dignity under Article 21. The State of West Bengal challenged these findings before the Supreme Court.

Issues of the Case:

- Whether DA payable under the RoPA Rules constitutes a legally enforceable right of State employees?

- Whether the State can deny or defer payment of DA on the ground of financial constraints?

- Whether DA forms part of the constitutional right to live with dignity under Article 21?

- Whether judicial review is permissible over State fiscal policies relating to payment of DA?

- Whether employees are entitled to DA revisions twice a year based on prevailing inflation indices?

Arguments of the Parties:

The State argued that DA is not an absolute or fundamental right and that parity with Central Government DA cannot be claimed as a matter of right, since service conditions of State employees are governed by Article 309 and different set of rules. The fiscal autonomy under the Constitution allows it to determine the timing, rate, and manner of DA payment, and that courts cannot interfere with economic and fiscal policy decisions, especially when the State is facing serious financial constraints.

The employees argued that DA is a component of wages, intended to offset inflation, and once incorporated under statutory rules, it becomes a legally enforceable right. They contended that non-payment or delayed payment of DA violated Article 21, as it affects the right to live with dignity. The State’s plea of financial hardship was rejected stating that it cannot defeat the purpose of a constitutional right.

Judgement and Analysis:

The Supreme Court dismissed the appeals filed by the state and upheld the judgments of the Calcutta High Court. It was held that DA becomes a statutory right after its incorporation into service rules framed under Article 309. Financial constraints cannot defeat the purpose of a legally enforceable right.

DA is a mechanism to reduce the impact of inflation and protect the standard of living of the employees. Non-payment or delayed payment of DA directly impacts the right to live with dignity under Article 21. The State is bound to pay DA arrears for the period 2008–2019. The Supreme Court also clarified that fiscal policies are subject to judicial review when they result in arbitrariness or violation of fundamental right. When fiscal decisions violate statutory rules or fundamental rights, courts have to intervene.

The court partly allowed the State’s appeal to the extent that the employees were not entitled to claim DA twice a year merely because inflation indices are updated biannually. However, once a State adopts an inflation-linked DA mechanism and follows a biannual revision practice, it cannot discontinue or alter it arbitrarily without valid justification.

Conclusion:

The Supreme Court’s decision clarified that DA comes under the purview of Article 21, and the State Government cannot resort to the defence of financial constraints to evade such responsibilities.